Dear visitor,

You're reading 1 of your 3 free news articles this quarter

Register with us for free to get unlimited news, dedicated newsletters, and access to 5 exclusive Premium articles designed to help you stay in the know.

Join the UK's leading credit and lending community in less than 60 seconds.

Bank of England sticks with 0.1% interest rates

The Bank of England (BoE) has resisted increasing rates to 0.25%, but predicts interest rates will need to rise “modestly” if inflation is to return to its target of two percent.

Senior Journalist across Credit Strategy, TRI and Reward Strategy

The Monetary Policy Committee voted by a majority of seven to two to keep interest rates at 0.1% and by a majority of six to three to maintain the amount of quantitative easing at £895bn.

However, the BoE expects inflation to rise to around five percent by spring 2022 due to high energy and goods prices. But the bank only expects these higher rates of inflation to be temporary; their prediction is that inflation will be close to their two percent target in two years time.

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown highlighted how the decision was bad for banks but good news for borrowers. She said: “There is clearly concern that if a rate rise is brought in too quickly, consumers and homeowners will feel too much of a pinch in their disposable incomes, and demand could spiral downwards, limiting the recovery even further.

“Lloyds, which earns the majority of its income from traditional lending activities, saw its share price fall by two percent as did NatWest, while Barclays fell by around one percent.”

The BoE recognised that there has been an increase in spending by households and businesses. Unemployment has fallen according to the bank, although the number of people out of work is still higher than it was before the pandemic.

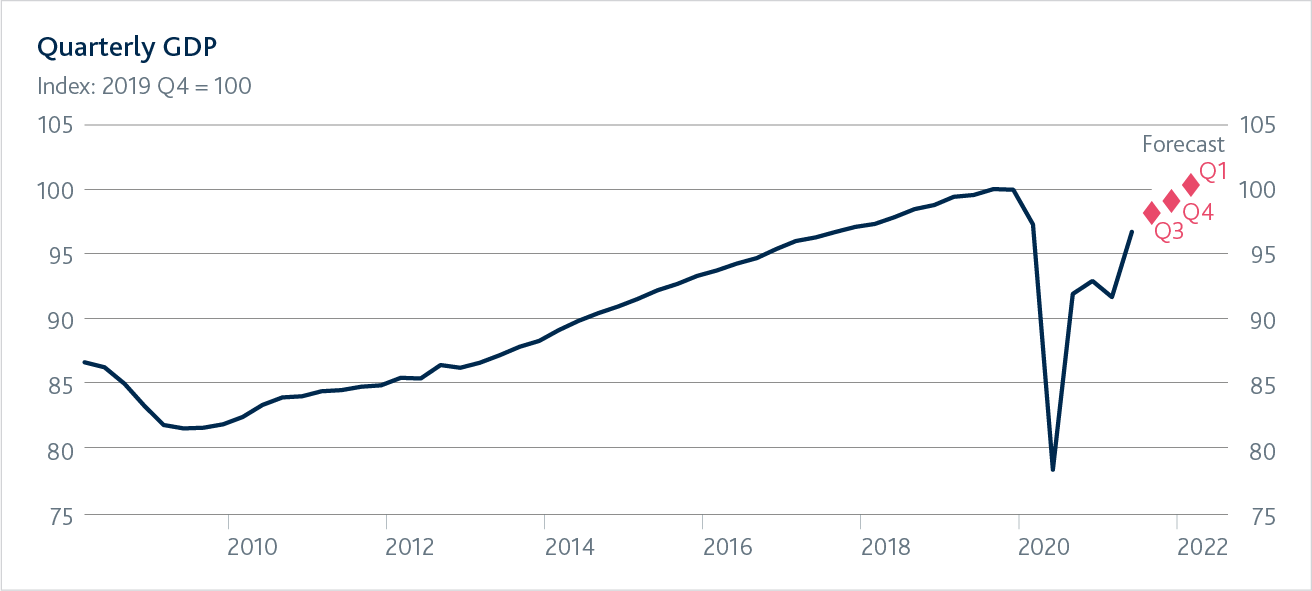

The size of the UK economy is still not at pre-pandemic levels according to the BoE, although it forecasts growth to be back on track by January 2022.

Size of the UK economy

Commenting on BoE maintaining the base rate at 0.1%, John Goodall, chief executive of Landbay, said: “I think we are looking at January now for the rate increase as December and the run up to Christmas is probably not the best time. I believe the base rate will go up to 0.25% with possibly a couple more rate rises in 2022 to take it up to 0.75% this time next year.”

Richard Pike, sales and marketing director at Phoebus Software, said: “There are still many people on variable rate mortgages that should be preparing for the first interest rate rise in three years. A small rise to 0.25%, predicted by many, may not be huge, but it is likely to be the start of things to come.”

The value of the pound fell by one percent on the dollar, following the news of the BoE leaving interest rates on hold.

Stay up-to-date with the latest articles from the Credit Strategy team

Get the latest industry news