Dear visitor,

You're reading 1 of your 3 free news articles this quarter

Register with us for free to get unlimited news, dedicated newsletters, and access to 5 exclusive Premium articles designed to help you stay in the know.

Join the UK's leading credit and lending community in less than 60 seconds.

Car ownership is "unaffordable"

Go Car Credit, who provide car finance for consumers with poor credit, has conducted a national study into the on-going cost of running a car

Deposits are often seen to be the most substantial expense, however, Go Car Credit’s study shines a light on the additional financial responsibilities that come along with car ownership. This includes repair costs, fuel, and insurance, among many others. Alongside this, the study reveals which car brands are cheaper to run in the long run.

After surveying over 1832 people with a nationally representative survey with Find Our Now, Go Car Credit found that:

- 47% of people have at least 1 car on their property

- Over half of people overall believe car ownership has become too expensive

- 82% of people say fuel is the biggest factor to this

- People also believed that Ford was one of the most reliable cars

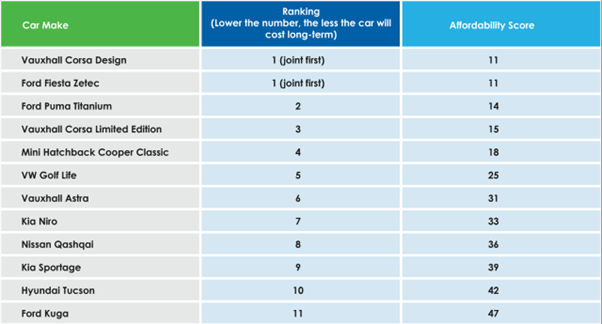

Using a point system based on initial purchase price, depreciation, average cost for a full tank of fuel, miles from a full tank, cost per mile, and insurance group cost they have created a league table of the on-going cost of popular cars.

Achieving joint first place in the rankings, the most affordable cars to run over time are the Vauxhall Corsa Design and the Ford Fiesta Zetec with an affordability score of 11. The Ford Kuga came in last place with an affordability score of 47 due to how much it would cost you to run the car over a long period of time.

The point system Go Car Credit used to calculate the affordability compromises of Initial purchase price, depreciation, average cost of for a full fuel tank, how many miles you can get on a full tank, cost per mile and insurance group.

Hayley O’Connor at Go Car Credit had this to say about the findings: “Car ownership is a real necessity for many people for commuting to work.” O’Connor highlighted: “Fuel prices have recently reached record levels so there is a level of trepidation about purchasing a car. It’s important to think about what is affordable long term.” Before concluding: “As a responsible lender, we offer car finance to those who may struggle to get credit from mainstream lenders, by making sure it is an affordable option.”

Stay up-to-date with the latest articles from the Credit Strategy team

Get the latest industry news