Dear visitor,

You're reading 1 of your 3 free news articles this quarter

Register with us for free to get unlimited news, dedicated newsletters, and access to 5 exclusive Premium articles designed to help you stay in the know.

Join the UK's leading credit and lending community in less than 60 seconds.

Global banks’ climate pledge not enough say NGOs

In one of the main successes of the COP26 summit, over 450 financial institutions in 45 countries pledged their support in the fight against climate change.

Senior Journalist across Credit Strategy, TRI and Reward Strategy

Hundreds of the world’s largest banks and pension funds with assets worth $130tn (£95tn) have committed to limiting greenhouse gas emissions as part of the new Glasgow Financial Alliance for Net Zero (GFANZ), which is chaired by former governor of the bank of England, Mark Carney.

Economists have estimated that about $100tn (£73bn) in investment is likely to be needed in the next three decades to meet the net zero by 2050 goal so, in theory, the amount pledged will provide more than enough cash to meet the goal.

However, experts told Credit Strategy that the $130tn (£95tn) figure is misleading.

Simon Youel, head of policy and advocacy at Positive Money, said: “The $130tn figure is intentionally misleading - it refers to the total assets of the financial institutions in the net zero alliance, not the amount of capital actually being mobilised towards the green transition.”

Sam Alvis, head of green renewal at the environmental think tank Green Alliance added: “Financial institutions are going to have to move the entirety of their investment portfolios to align with net zero. The figures quoted here are a huge uplift, 25 times what we’ve had previously, but it’s not enough or moving fast enough”.

Climate organisations and campaigners have also said that more critical action is needed by financial institutions to limit the funding they provide to fossil fuel projects.

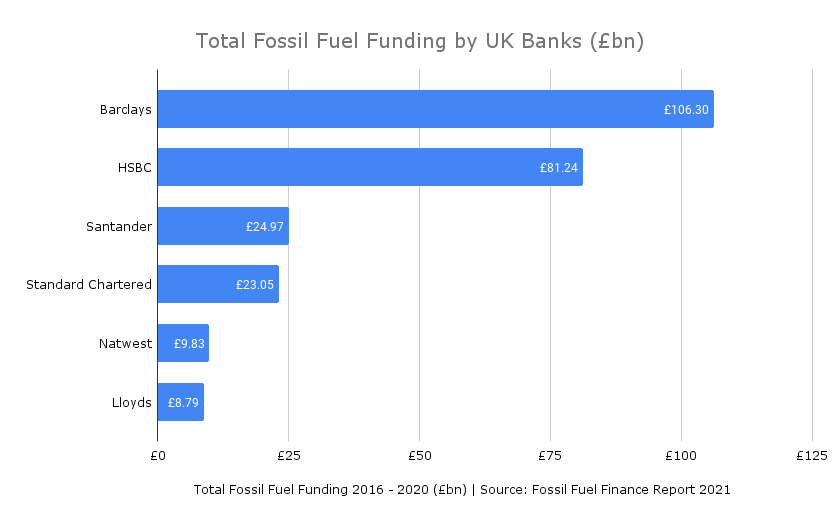

According to a March 2021 report by a coalition of non-governmental organisations, six of the UK’s biggest banks have provided more than £254bn in financing for fossil fuel companies since the Paris climate deal in 2015.

Examples of funding include providing investment and debt financing for new coal mines and offshore oil and gas rigs.

The announcement comes as some of the other aims of the summit – namely, setting the world on a path to limit global warming to 1.5C – are looking unlikely to be reached.

On Wednesday morning (3 November), the chancellor of the exchequer, Rishi Sunak, announced that the UK will become the world’s first net zero financial centre.

This means that from 2023 it will become “mandatory for firms to publish a clear, deliverable plan setting out how they will decarbonise and transition to net zero”.

In response to the chancellor’s announcement, Sam Alvis of Green Alliance, said: “Finance ministers being front and centre at a UN Climate Summit for the first time is welcome. It is definite progress that the chancellor has got the treasury on the pitch at COP26. But trillions of dollars are still flowing to fossil fuels every day and voluntary measures have not got us far enough.

“To keep the 1.5 degree target alive, governments will need to regulate companies not just to publish transition plans but have strict criteria with legal bite on their credibility and pace.”

Stay up-to-date with the latest articles from the Credit Strategy team

Get the latest industry news