Dear visitor,

You're reading 1 of your 3 free news articles this quarter

Register with us for free to get unlimited news, dedicated newsletters, and access to 5 exclusive Premium articles designed to help you stay in the know.

Join the UK's leading credit and lending community in less than 60 seconds.

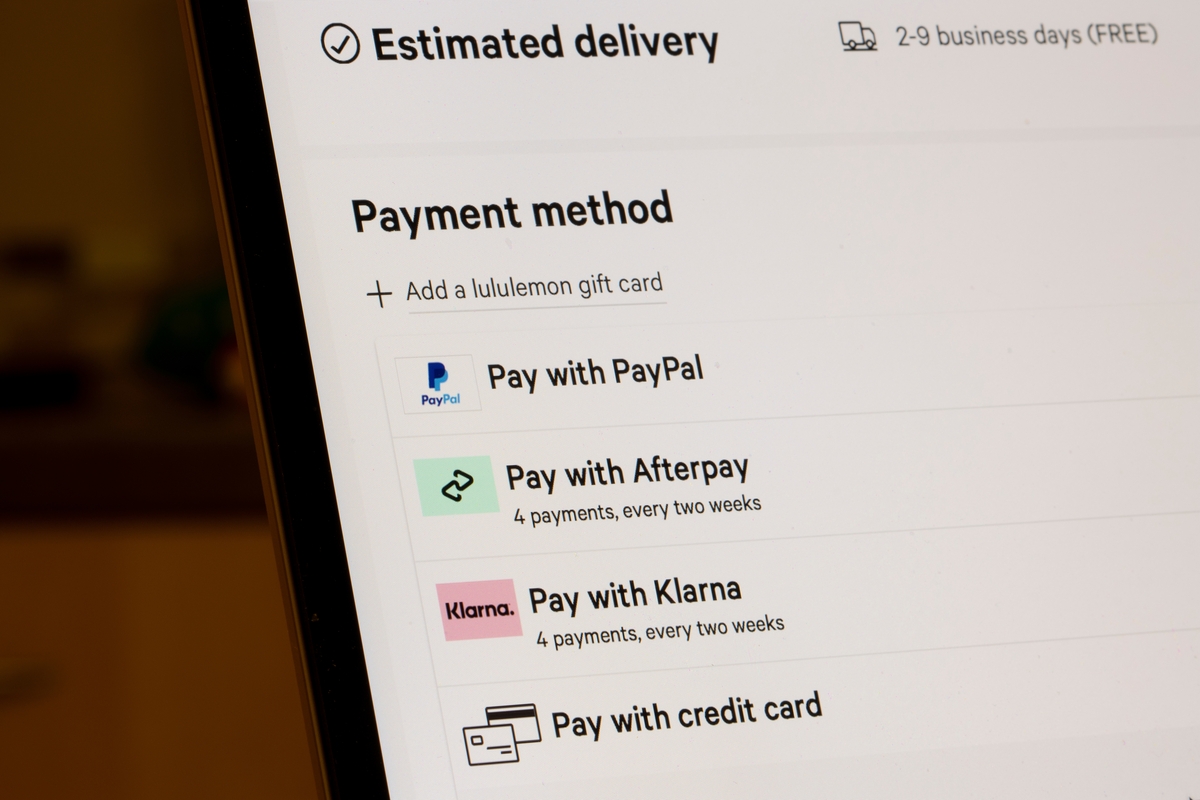

Government accused of inaction over “buy now, pay later” lenders

Labour has accused ministers of dragging their feet in regulating the buy now, pay later (BNPL) sector.

Senior Journalist, covering the Credit Strategy and Turnaround, Restructuring & Insolvency News brands.

According to the Financial Times, shadow City minister Tulip Siddiq has written to her counterpart in government Andrew Griffith claiming that policies – promised back in February 2021 – to make sure BNPL products came with the right protections were being “kicked into the long grass” ahead of the next general election.

She said: “I recognise that many people value BNPL deals, as they can be a useful way to budget and pay for items. But the government’s failure to regulate the sector has left millions at risk from bad actors in the market.”

According to the Financial Times, ministers are grappling with the trade-offs involved in regulating a sector amid the risk that some operators could leave the market if rules are too severe, however government insiders say Griffith is determined to press ahead regulation – while the treasury hoped to respond to its recent consultation this autumn.

The government department told the outlet: ““Regulation of buy now, pay later products must be proportionate so borrowers are protected, while still being able to access these useful interest-free products. No decisions have been made as we are reviewing the responses to our recent consultation and will report back in due course.”

See more of our BNPL coverage:

BNPL purchases up by 73 at the end of 2022

One in five teachers reliant on BNPL

Two fifths borrowed to pay off buy now pay later

Most UK BNPL users don’t think they can lead to debt

Stay up-to-date with the latest articles from the Credit Strategy team

Get the latest industry news