Dear visitor,

You're reading 1 of your 3 free news articles this quarter

Register with us for free to get unlimited news, dedicated newsletters, and access to 5 exclusive Premium articles designed to help you stay in the know.

Join the UK's leading credit and lending community in less than 60 seconds.

Inflation reaches ten year high

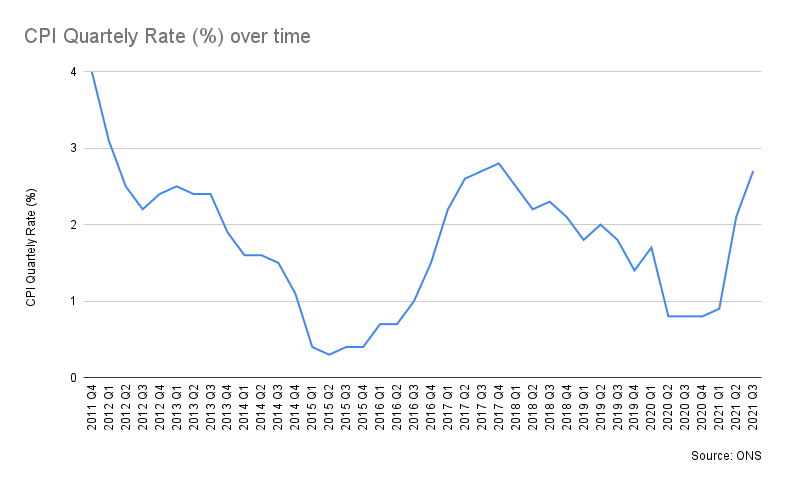

The consumer price index (CPI) climbed by 4.2% in the year to October, piling pressure on the Bank of England (BoE) to raise interest rates.

Senior Journalist across Credit Strategy, TRI and Reward Strategy

UK inflation has reached its highest level since November 2011 after a bigger than expected jump in October. The CPI has increased from 3.1% in September, according to data from the Office for National Statistics (ONS).

The rise was more than double the 2% target set by the BoE earlier this month and was higher than the 3.9% forecast by economists polled by Reuters.

The rise in inflation is driven by a general increase in the cost of goods for consumers measured by the CPI. Most notable rises were in the cost of electricity, gas and other fuels, which rose by 23% in October.

Other notable price increases were seen in second hand cars, restaurants and hotel accommodation.

Rising inflation has left economists speculating whether the BoE will be forced to raise interest rates in December. This increase in the cost of debt will be a worry for mortgage owners and borrowers.

Joanna Elson CBE, chief executive of the Money Advice Trust, the charity that runs National Debtline and Business Debtline, said: “At National Debtline nearly four in ten callers do not have enough coming in to cover essential outgoings. As the cost of living continues to increase, our concern is that more people will be pushed into difficulty.”

In their meeting this month, the BoE predicted inflation to peak at 5% in April 2022.

Stay up-to-date with the latest articles from the Credit Strategy team

Get the latest industry news