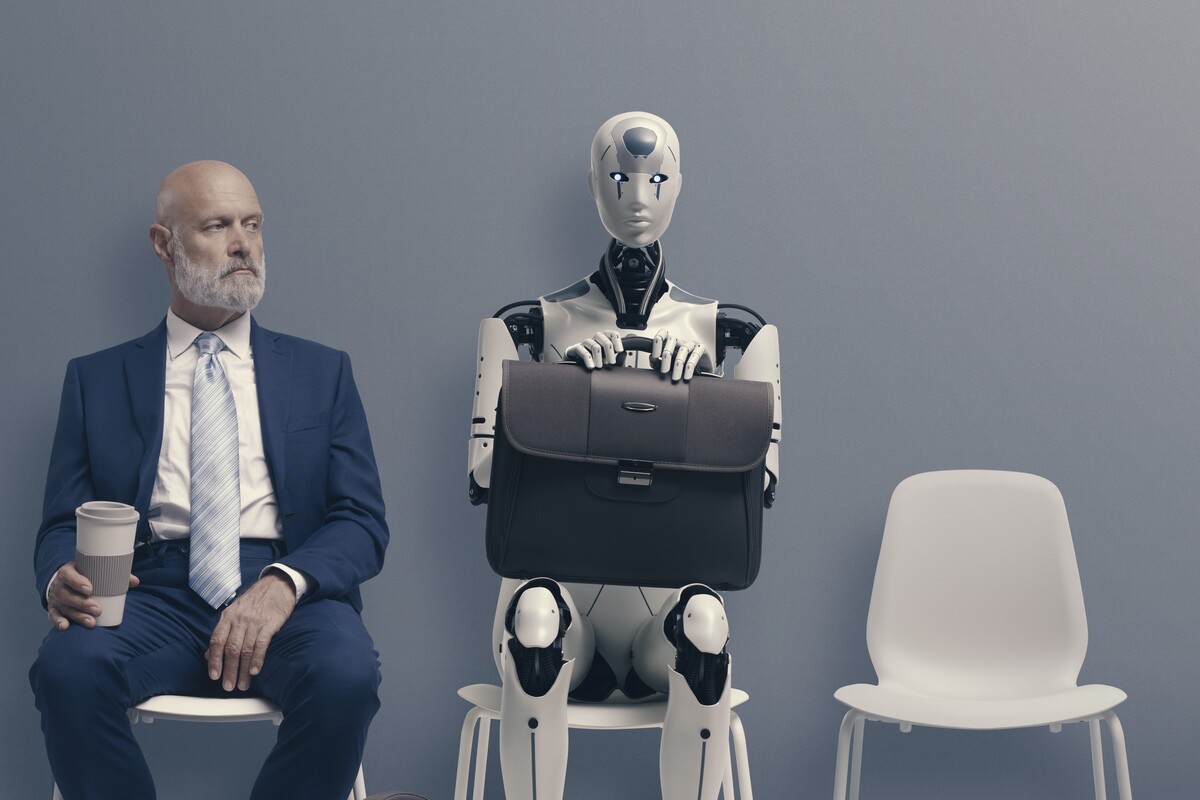

AI causing concern among finance bosses

63% of European Financial Services believe not enough is being done to prepare the sector for “unintended consequences” of AI, reveals an EY survey

Assistant Editor, Reward Strategy

According to the EY CEO Outlook Pulse Survey, deep fakes are a particular worry among financial service bosses, with ‘bad actors’ using AI to spread misinformation cited among a host of potential issues including privacy risks and ethical usage.

Despite these concerns, 90 out of 96 chief executives in the financial sector surveyed were enthusiastic about adding AI to their capital allocation, with over half having already invested in the tech.

Dr Yi Ding, Assistant Professor of Information Systems at the Gillmore Centre for Financial Technology, commented, “Innovation is key for the financial services industry and limiting AI research and implementation will only hold the sector back. As with any new technology, organisations must be aware of the risks it poses, but artificial intelligence has already proven itself a valuable tool for tasks such as data analysis to support the detection of financial criminals, chatbots to support customer service in online banking, and forecasting to support strategic decision making for business growth. Missing out on these benefits is not an option for such a fast-moving sector.”

“The financial services sector should embrace the R&D programmes being undertaken by academic institutions for the trustworthy development of AI and prioritise a safety-first approach during its adoption. Once staff are given proper training, and organisations mitigate the risks, they will be able to reap the significant benefits that AI has to offer the industry.”

Stay up-to-date with the latest articles from the Credit Strategy team

READ NEXT

FCA commits to launching fewer “large-scale” initiatives

Thames Water wins court backing for emergency debt package

Supreme Court blocks Treasury intervention in motor finance appeal

Get the latest industry news