Dear visitor,

You're reading 1 of your 3 free news articles this quarter

Register with us for free to get unlimited news, dedicated newsletters, and access to 5 exclusive Premium articles designed to help you stay in the know.

Join the UK's leading credit and lending community in less than 60 seconds.

Close Brothers tops consumer credit complaints table

Official figures from the Financial Conduct Authority (FCA) reveal Close Brothers saw the highest number of consumer credit complaints opened against it for a half-year period in 2019 - at just over 37,000.

The FCA’s complaints data relates to the second half of 2019, or a six-month period within last year for some companies, and includes information from firms that report 500 or more complaints within this reporting period.

The statistics show that between February and July last year, Close Brothers Ltd had 37,155 complaints opened against it, while 37,660 complaints were closed and 11.8 percent were upheld.

Shop Direct had the second highest with 20,823 consumer credit cases opened, 19,870 closed and 35.6 percent upheld, between July and December 2019.

Third highest was NewDay, with 20,691 cases opened, 15,413 closed and 46 percent upheld, during the same period.

Of the top five firms with most consumer credit complaints, Caversham Finance, which trades as the rent-to-own retailer BrightHouse that’s now in administration, had the highest proportion upheld – at 57.9 percent.

The top five firms with most consumer credit complaints for H2 can be seen here:

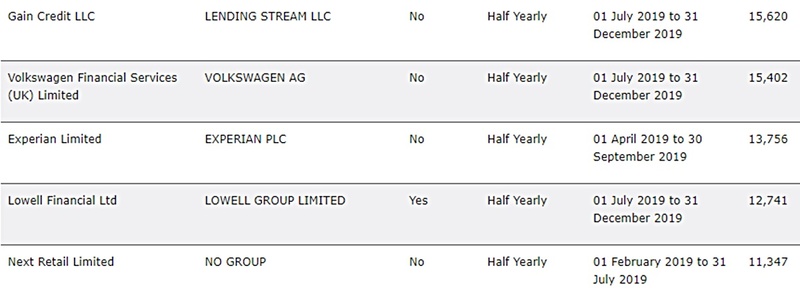

The remaining top 10 firms with most consumer credit complaints, for H2 2019:

Banking and credit credit cards

Across other types of disputes, Barclays had the highest banking and credit card complaints of all lenders, at 215,731, between July and December last year. Barclays also had the highest of all total complaints, at over one million.

This was over 400,000 more than the next highest - Lloyds Banking Group - which received 627,236 total complaints during the same period.

Here are the figures showing the top 10 lending brands that received the most banking and credit card complaints for H2 last year:

Barclays Bank UK - 215,731;

HSBC UK Bank - 206,194;

NatWest Bank - 115,315;

Santander UK - 111,582;

Lloyds Bank - 109,565;

Bank of Scotland plc - 77,406;

Nationwide Building Society - 45,573;

TSB Bank - 43,327;

RBS - 34,483;

Capital One - 23,539.

Generally across all types of complaints, the FCA’s data showed an increase from 4.29 million in the first half of last year to 6.02 million in the second.

This was driven mainly by a 75 percent rise in PPI cases, from 2.12 million to 3.71 million. PPI was still the most complained-about product, a factor driven largely by claims management companies pursuing cases. This total was also the highest level of PPI cases ever reported to the FCA, aligning with the claims deadline of August 29 2019.

The data shows that fewer PPI complaints were closed in eight weeks by firms, down from 76 percent in 2019 H1 to 56 percent in H2. A total of 50 percent of PPI complaints were upheld in H2.

There was also a six percent increase in all other complaint volumes compared with 2019 H1 - to 2.31 million from 2.18 million. Excluding PPI, the most complained about products were current accounts and credit cards.

Stay up-to-date with the latest articles from the Credit Strategy team

Get the latest industry news