Dear visitor,

You're reading 1 of your 3 free news articles this quarter

Register with us for free to get unlimited news, dedicated newsletters, and access to 5 exclusive Premium articles designed to help you stay in the know.

Join the UK's leading credit and lending community in less than 60 seconds.

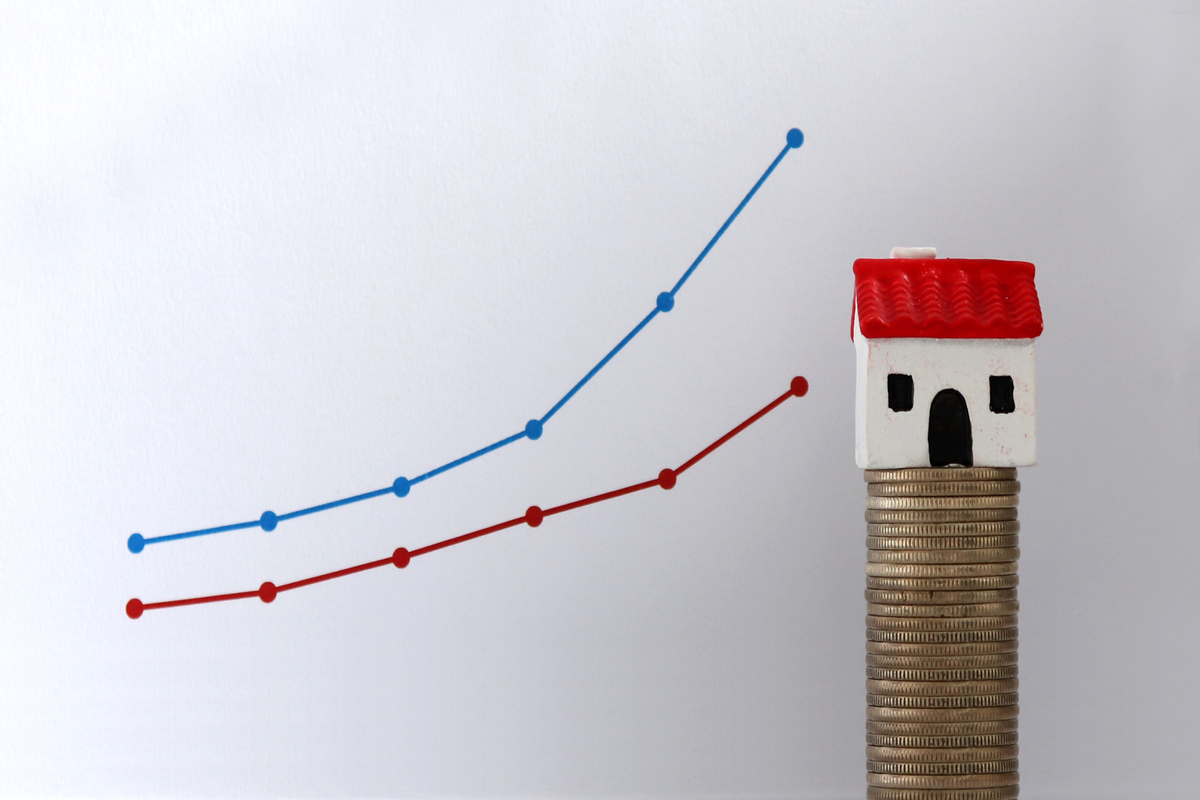

14-year high for two-year mortgage rates

The average two-year mortgage rate is at its highest level for 14 years, sitting at 6.07 per cent, according to data from Moneyfacts.

The current level of 6.07 per cent hasn’t been seen since the financial crisis of 2008, with Moneyfacts reporting that it hit 6.31 per cent in 2008.

The rates have been steadily going up for months, but in the aftermath of the governments mini-budget they saw a sharp rise, affecting first-time-buyers and consumers who are looking to re-mortgage their homes.

Uncertainty over future interest rates led many mortgage providers withdrawing their products from the market, over 40% of mortgage products were made unavailable.

Many of the major providers who withdrew products have returned them to the market, although at a much higher rate.

On the morning of the budget announcement the average two-year fixed rate was at 4.74 per cent, seeing a near two-point rise. Five-year fixed rates have seen a similar rise, going up by 1.22 per cent since the announcement.

Some lenders have been setting rates higher than 6.07, such as specialist lenders who offer mortgages to marginalised areas of the market, such as those with poor credit scores, have been offering rates closer to 6.5-7per cent.

Following the reversal of the 45p income tax rate, there was hope among consumers and economists that it would lead to calmer market rates and cheaper mortgage deals as lenders’ confidence rose. Unfortunately, it appears that the opposite has happened instead.

Sky News have reported that executives from Britain’s biggest high-street lenders have been summoned for talks with the Chancellor, Kwasi Kwarteng. Bosses from Barclays, Lloyds Banking Group and NatWest are expected to attend. This follows weeks of market turmoil and uncertainty.

Stay up-to-date with the latest articles from the Credit Strategy team

Get the latest industry news